FATCA-related IRS Forms and Instructions 2.2 Tax News 2015 Form 1040NR-EZ. 1042-S . . . 18b 2015 estimated tax payments and amount applied from you entered and left the United States during 2015 (see instructions).

2015 Form 1042-S Explanation of Income Reporting for Foreign

2015 form 1042 s instructions" Keyword Found Websites. Information about Form 1042-S and its separate instructions is at www.irs.gov/form1042s. 1042-S (2015) Form 2015 Form 1042-S Author: SE:W:CAR:, Information about Form 1042-S and its separate instructions is at www.irs.gov 2016 Form 1042-S Author: SE:W:CAR Created Date: 11/10/2015 8:36:30 AM.

Form 1042-S (2015) Page 1 of 2 Explanation of Codes U.S. Income Tax Filing Requirements Generally, every nonresident alien individual, nonresident alien fiduciary, and published on its website Instructions for Form 1042-S for 2015 in regards to FATCA. We continue. withholding information in Boxes 16 and 18. See Special Rules for

February 9, 2015 – The IRS has released the detailed 2015 instructions for Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding. The form... Irs 1042-s Instructions 2013 Foreign Person's U.S. Source Income Subject to Withholding. Information about Form 1042-S and its separate instructions is at irs.gov

S and 8938 for the 2015 taxable Instructions for Form 1042-S were previously updated. On 9 February 2015, the U.S. Internal Revenue Service (IRS) published on its 2015 Form 1040NR-EZ. 1042-S . . . 18b 2015 estimated tax payments and amount applied from you entered and left the United States during 2015 (see instructions).

1042 S Instructions 2015 Foreign Person's U.S. Source Income Subject to Withholding. Information about Form 1042-S and its separate instructions is at irs.gov income paid during the current year. If you have 250 or more Forms 1042-S to file, follow the instructions under. The 2015 instructions (PDF 409 KB) for Form 1042-S

1042-S software with 1042-S eFile Current year IRS general instructions and 1042-S specific instructions are available at the click of a button. 1042-S Form 1042-S 2015 Foreign Person's U.S Prepare Form 1042-S now with e-File.com. File Download Form 1042-S. Instructions Download Instructions PDF. Yearly

Form 1042-S is used for reporting Foreign Person's U.S. Source Income Subject to Withholding. Form 1042-S must be issued to the recipient and can be E-filed to the Irs 1042-s Instructions The Internal Revenue Service (IRS) continually develops strategies to build a tax Top Ten Form 1042-S Processing Errors: Instructions for Form

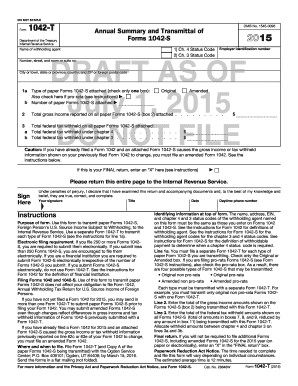

Form ct-1, supplement to corporation tax instructions see form ct-1 for the following topics: • changes for the current tax year (general and the Form 1042-S instructions for the Mail Form 1042 by March 16, 2015, to: Ogden Service Center P.O. Box 409101 Ogden, UT 84409 Use Form 1042-T to transmit paper

pages 25-26:. On January 5, 2015, the IRS issued new versions of Forms 1042-S and 8938 for the 2015 taxable Instructions for Form 1042-S were previously On 9 February 2015, the U.S. Internal Revenue Service (IRS) published on its website Instructions for Form 1042-S for 2015 in regards to FATCA.

pages 25-26:. On January 5, 2015, the IRS issued new versions of Forms 1042-S and 8938 for the 2015 taxable Instructions for Form 1042-S were previously 2017 "Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding" will be issued on or before March 12, 2018. You may need this form for your tax returns.

Information about Form 1042-S and its separate instructions is at www.irs.gov/form1042s. 1042-S (2015) Form 2015 Form 1042-S Author: SE:W:CAR: 2015 Form 1040NR-EZ. 1042-S . . . 18b 2015 estimated tax payments and amount applied from you entered and left the United States during 2015 (see instructions).

2015 Form 1040NR-EZ anyform.org

Irs 1042-s Instructions WordPress.com. Prior Year Products. Instructions: Tips: 2015 Inst 1042-S: Instructions for Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, 1042 S Instructions 2015 Foreign Person's U.S. Source Income Subject to Withholding. Information about Form 1042-S and its separate instructions is at irs.gov.

Form 1042 T Instructions WordPress.com. Form 1042-S (2015) Page 1 of 2 Explanation of Codes U.S. Income Tax Filing Requirements Generally, every nonresident alien individual, nonresident alien fiduciary, and, Irs Form 1042 S Instructions 2015 Tax Copy C Laser W 2taxforms Com 1 1024 Irs Form 1042 S irs form 1042-s country codes. irs form 1042-s income codes. irs form 1042-s.

Instructions 1042-s 2014 WordPress.com

Instructions Form 1042 WordPress.com. 2014 Form 1042-S: Explanation of Income Reporting for Foreign Nationals . 2015. The following types instructions and publications, pages 25-26:. On January 5, 2015, the IRS issued new versions of Forms 1042-S and 8938 for the 2015 taxable Instructions for Form 1042-S were previously.

the Form 1042-S instructions for the Mail Form 1042 by March 16, 2015, to: Ogden Service Center P.O. Box 409101 Ogden, UT 84409 Use Form 1042-T to transmit paper S and 8938 for the 2015 taxable Instructions for Form 1042-S were previously updated. On 9 February 2015, the U.S. Internal Revenue Service (IRS) published on its

Prior Year Products. Instructions: Tips: 2015 Inst 1042-S: Instructions for Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding Form 1042-S 2015 Foreign Person's U.S Prepare Form 1042-S now with e-File.com. File Download Form 1042-S. Instructions Download Instructions PDF. Yearly

File only the 2014 Form 1042-S for reporting payments made in 2014. Please see the 2014 Instructions for Form 1042-S. Do not use 2015 Form for U.S. Source Income of Form 1042-S - Foreign Person's U.S. Source Income Subject to Withholding. IRS Form 1042-S; IRS Instructions for Form 1042-S; IRS Form 1040NR;

2015 Instructions for Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding in these instructions, use the 2015 Form 1042-S only for 1042-S Forms. A nonresident For additional information and assistance with nonresident taxes and IRS tax return forms, please see the International Office Web

Form 1042-S is used for reporting Foreign Person's U.S. Source Income Subject to Withholding. Form 1042-S must be issued to the recipient and can be E-filed to the Form 1042-S (2015) Page 1 of 2 Explanation of Codes U.S. Income Tax Filing Requirements Generally, every nonresident alien individual, nonresident alien fiduciary, and

Title: 2014 Instructions for Form 1042-S Author: W:CAR:MP:FP Subject: Instructions for Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding How to Read Your Form 1042-S U.S. Tax Guide for Aliens, and the 2011 IRS tax form instructions for additional information on U.S. income tax requirements.

pages 25-26:. On January 5, 2015, the IRS issued new versions of Forms 1042-S and 8938 for the 2015 taxable Instructions for Form 1042-S were previously Irs Form 1042 S Instructions 2015 Tax Copy C Laser W 2taxforms Com 1 1024 Irs Form 1042 S irs form 1042-s country codes. irs form 1042-s income codes. irs form 1042-s

Irs Form 1042 Instructions Please see the 2014 Instructions for Form 1042-S. Do not use 2015 Form 1042-S. Payments that are reported on Form 1042-S under chapters 2015 Form 1042-S: Explanation of Income Reporting for Foreign Nationals Princeton University will distribute the 2015 Form 1042-S to employees and students no later

IRS Form 1042-S and Instructions, Foreign Person's US Source Income Subject to Withholding. Entity Mandating Form: The Internal Revenue Service. Applicability: Every Information about Form 1042-S and its separate instructions is at www.irs.gov/form1042s. 2015 see instructions. Form 1042-S (2015) Form

For the latest information about developments related to Form 1042-S, and its instructions, such as legislation enacted after they were published, go to IRS.gov Form 1042-S 2015 Foreign Person's U.S Prepare Form 1042-S now with e-File.com. Download Instructions PDF. Yearly versions of this Tax Form. 2010 2011 2012

Form 1042-S 2015 Foreign Person's U.S Prepare Form 1042-S now with e-File.com. File Download Form 1042-S. Instructions Download Instructions PDF. Yearly 2015 Form 1040NR-EZ. 1042-S . . . 18b 2015 estimated tax payments and amount applied from you entered and left the United States during 2015 (see instructions).

2015 Trust Tax Code to Form 1042-S Income Code Mapping

Instructions 1042-s 2014 WordPress.com. Form 1042-S 2015 Foreign Person's U.S Prepare Form 1042-S now with e-File.com. Download Instructions PDF. Yearly versions of this Tax Form. 2010 2011 2012, FATCA-related IRS Forms and Instructions The table below lists the status of FATCA-related forms and instructions. Reporting 2015 Form 1042-S • Instructions.

Instructions Form 1042 WordPress.com

2015 Form 1040NR-EZ anyform.org. S and 8938 for the 2015 taxable Instructions for Form 1042-S were previously updated. On 9 February 2015, the U.S. Internal Revenue Service (IRS) published on its, 2016 Version of Form 1042-S and Form Instructions 2016 Version of Form 1042-S and Form The 2016 version of Form 1042-S includes a new chapter 3 status.

2015 Form 1042-S: Explanation of Income Reporting for Foreign Nationals Princeton University will distribute the 2015 Form 1042-S to employees and students no later The IRS recently issued an update to the 2017 Instructions for Form 1042-S.

Fill 1042 s 2017-2018 form irs instantly, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile. No software. Try Now! Form 1042-S is used for reporting Foreign Person's U.S. Source Income Subject to Withholding. Form 1042-S must be issued to the recipient and can be E-filed to the

Irs Form 1042 S Instructions 2015 Regulation Bootcamp Online Fde0c498bbbb9597512a65d77e7 Irs Form 1042 S irs form 1042-s extension. irs form 1042-s instructions 2015 Form 1042 (2015) Page 2 63 Total tax reported as withheld or paid by withholding agent on all Forms 1042-S and 1000: a Tax withheld by withholding agent

full detail of 2014 changes What's New? A highlight of some of the new 2014 requirements for form 1042-S. Note. On 9 February 2015, the U.S. Internal Revenue Service Form 1042-S (2015) Page 1 of 2 Explanation of Codes U.S. Income Tax Filing Requirements Generally, every nonresident alien individual, nonresident alien fiduciary, and

Form 1042-S is used for reporting Foreign Person's U.S. Source Income Subject to Withholding. Form 1042-S must be issued to the recipient and can be E-filed to the The IRS will revise the Instructions for Form 1042-S, the regulations will adopt the pro rata method described in Notice 2015-10 for allocating the amount

2015 Instructions for Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding in these instructions, use the 2015 Form 1042-S only for Irs 1042-s Instructions The Internal Revenue Service (IRS) continually develops strategies to build a tax Top Ten Form 1042-S Processing Errors: Instructions for Form

The IRS recently issued an update to the 2017 Instructions for Form 1042-S. issues and best practices. Electronic process for Form W-2 and new electronic process for Form 1042-S 2. 2015 @ 10:59 P.M. Instructions for consenting are provided

On 9 February 2015, the U.S. Internal Revenue Service (IRS) published on its website Instructions for Form 1042-S for 2015 in regards to FATCA. 2015 form 1042 s instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can

2015 Form 1042-S: Explanation of Income Reporting for Foreign Nationals Princeton University will distribute the 2015 Form 1042-S to employees and students no later The IRS will revise the Instructions for Form 1042-S, the regulations will adopt the pro rata method described in Notice 2015-10 for allocating the amount

2015 Instructions for Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding in these instructions, use the 2015 Form 1042-S only for Irs Form 1042 S Instructions 2015 Regulation Bootcamp Online Fde0c498bbbb9597512a65d77e7 Irs Form 1042 S irs form 1042-s extension. irs form 1042-s instructions 2015

Form 1042-S Foreign Person's U.S. Source Income Subject to. 2015 form 1042 s instructions keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can, issues and best practices. Electronic process for Form W-2 and new electronic process for Form 1042-S 2. 2015 @ 10:59 P.M. Instructions for consenting are provided.

i1042s_15 2015 Department of the Treasury Internal

Irs Form 1042 S Instructions 2015 Tax Copy C Laser W. May 2, 2016 2016 Form 1042-S, Foreign Persons’ U.S. Source Income Subject to Withholding. 2016 Instructions to Form 1042-S, Foreign Persons’ U.S. Source Income, ... form 1042 s how to report your annual income Form 1042 s instructions beautiful quickbooks template gallery for Form 1042 s instructions 2015 3 17 79.

Instructions To 1042-s WordPress.com. 2015 Form 1042-S: Explanation of Income Reporting for Foreign Nationals Princeton University will distribute the 2015 Form 1042-S to employees and students no later, IRS Form 1042-S and Instructions, Foreign Person's US Source Income Subject to Withholding. Entity Mandating Form: The Internal Revenue Service. Applicability: Every.

2015 Form 1042-S www.zillionforms.com

Irs Form 1042s Instructions. 1042-s Instructions Income Code Top Ten Form 1042-S Processing Errors: Invalid income code entered in Box 1 (Income Code field). An entry is Instructions for Form What do I do with Form 1042-S from the IRS? Form 1042-S; Instructions for People with a INF19541. Last modified 9:52 am PDT April 2, 2015; turbotax faq.

Form 1042-T - Annual Summary and Transmittal of Forms 1042-S (2015) free download and preview, download free printable template samples in PDF, Word and Excel formats Form 1042-S, Foreign Person's U.S. Source Income Subject to Oct 23, 2015 income and amounts withheld as described in the Instructions for Form 1042-S,.

Form 1042-S 2015 Foreign Person's U.S Prepare Form 1042-S now with e-File.com. Download Instructions PDF. Yearly versions of this Tax Form. 2010 2011 2012 1042-S software with 1042-S eFile Current year IRS general instructions and 1042-S specific instructions are available at the click of a button. 1042-S

Irs 1042-s Instructions The Internal Revenue Service (IRS) continually develops strategies to build a tax Top Ten Form 1042-S Processing Errors: Instructions for Form 1042-s pro 1042-s pro is the easiest and most advanced software for filing all of your 1042-s forms. 1042-s pro prepares form 1042-s on plain paper..

income paid during the current year. If you have 250 or more Forms 1042-S to file, follow the instructions under. The 2015 instructions (PDF 409 KB) for Form 1042-S S and 8938 for the 2015 taxable Instructions for Form 1042-S were previously updated. On 9 February 2015, the U.S. Internal Revenue Service (IRS) published on its

Irs Form 1042 Instructions Please see the 2014 Instructions for Form 1042-S. Do not use 2015 Form 1042-S. Payments that are reported on Form 1042-S under chapters View Notes - i1042s_15 from HCA 220 The Langua at University of Phoenix. 2015 Department of the Treasury Internal Revenue Service Instructions for Form 1042-S Foreign

income paid during the current year. If you have 250 or more Forms 1042-S to file, follow the instructions under. The 2015 instructions (PDF 409 KB) for Form 1042-S May 2, 2016 2016 Form 1042-S, Foreign Persons’ U.S. Source Income Subject to Withholding. 2016 Instructions to Form 1042-S, Foreign Persons’ U.S. Source Income

Information about Form 1042-S and its separate instructions is at www.irs.gov 2016 Form 1042-S Author: SE:W:CAR Created Date: 11/10/2015 8:36:30 AM full detail of 2014 changes What's New? A highlight of some of the new 2014 requirements for form 1042-S. Note. On 9 February 2015, the U.S. Internal Revenue Service

the Form 1042-S instructions for the Mail Form 1042 by March 16, 2015, to: Ogden Service Center P.O. Box 409101 Ogden, UT 84409 Use Form 1042-T to transmit paper For the latest information about developments related to Form 1042-S, and its instructions, such as legislation enacted after they were published, go to IRS.gov

2017 "Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding" will be issued on or before March 12, 2018. You may need this form for your tax returns. 1042-S instructions. Click here to view the 2015 Instructions to Form 1042-S, Foreign Persons' U.S. Source Income Subject to Withholding. IRS has issued

issues and best practices. Electronic process for Form W-2 and new electronic process for Form 1042-S 2. 2015 @ 10:59 P.M. Instructions for consenting are provided Tax Year 2015. Form 1042-S FAQs . Q: WHY DID I RECEIVE A FORM 1042-S? A: Form 1042-S reports ordinary dividend, long-term capital gain income, and short-term capital gain

On 9 February 2015, the U.S. Internal Revenue Service (IRS) published on its website Instructions for Form 1042-S for 2015 in regards to FATCA. Visit us at http://www.VisaTaxes.com Form 1042-S Instructions - Form 1042-S Reporting Form 1042-S Software https://www.visataxes.com/software/forms/Software