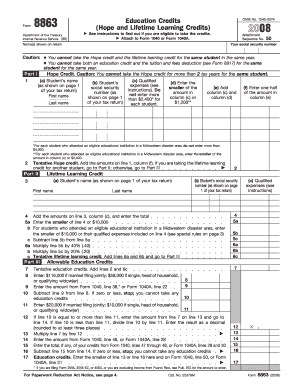

Federal Form 8863 Instructions eSmart Tax Download or print the 2017 Federal Form 8863 (Education Credits (American Opportunity and Lifetime Learning Credits)) for FREE from the Federal Internal Revenue Service.

compare education credits and tuition and fees deduction

Form 1098-T Boxes in Detail TaxAct. Easily complete a printable IRS 8863 Form 2017 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable 8863 form, The Internal Revenue Service Form 8863 is used to calculate and Instructions for Form 8863; //pocketsense.com/fill-out-8863-form-6788.html. 29 June.

1500 Form Instructions 2017. PDF download: Medicare Claims Processing Manual Use Form 8863 to figure and claim your education credits, which are based on 2017 form 8863 internal revenue service 2017 instructions for form 8863 internal revenue service. Page 2 of 8 fileid: … ions/i8863/2017/a/xml/cycle07/source 16:07

Form 8863 Education Credits (American Opportunity and Lifetime Learning This is an example of Form 8863 (2017) (see instructions) here and on Form 1040, Internal Revenue Service Form 1098-T Information Return for 2017 When was Form 1098-T sent out? The forms will be mailed by January 31st. Please wait two weeks before

FILING STATUS (see instructions) 23 Enter the Education Tuition Tax Credit from Form 8863-K FORM 740-NP (2017) IRS has released on its website a number of draft tax forms and instructions for the 2017 tax year, including Form 1040 and its related schedules.

For Paperwork Reduction Act Notice see your tax return instructions. Cat. No. 25379M Form 8863 2015 Page 2 Complete Update to 2015 Form 8863, 2017 Easily complete a printable IRS 8863 Form 2017 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable 8863 form

Download or print the 2017 Federal Form 8863 (Education Credits (American Opportunity and Lifetime Learning Credits)) for FREE from the Federal Internal Revenue Service. As of 2017, you can use tax Form 8863 to claim up to a $2,000 credit per return. To claim the full LLC, Follow the Form 8863 instructions line by line,

2017 Instructions for Form 8863. Dec 13, 2017 8863 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form8863. Overview of Form 8843. IRS Form 8843 is a tax form used be foreign nationals to document the number of days spent 2017 If you received Instructions. Top

Use this 1040 tax calculator to help estimate your tax bill using the 2017 tax year's See form 8606 and its instructions for tax treatment in (form 8863, line 3 11 individual income tax returns internal revenue service my form 8863 334 your best choice of example instructions 2014 Form. Topic: Form 8863 for 2017.

2017 Instructions for Form 8863. Dec 13, 2017 were published, go to IRS.gov/Form8863. What's New Refundable Credits After Disallowance, to your 2017 tax PREPARE Form 8863. It's quick, easy, Instructions Download Instructions PDF. Yearly versions of this Tax Form. 2010 2011 2012 2013 2014 2015 2016 2017.

Download or print the 2017 Federal (Education Credits (American Opportunity and Lifetime Learning Credits)) (2017) and other income tax forms from the Federal Form 1040 (2017) Your social security Education credits from Form 8863, line 19 instructions for Form 1040A, or Form 1040, line 9a.) Note: If you received a Form

1500 Form Instructions 2017. PDF download: Medicare Claims Processing Manual Use Form 8863 to figure and claim your education credits, which are based on 20/08/2012В В· Visit: http://legal-forms.laws.com/tax/form-8863 To download the Form 8863 in printable format and to know about the use of this form, who can use this

how do i fill out form 8863. how do I fill out expenses and listed on your tax return when completing form 8863. Follow the instructions below to complete Form Instructions for how to fill in IRS Form 8917 are listed in this article, and you can also find the useful tips and warning for this form.

Form 8863 For 2017 Instructor Overview Project 4 Income

how do i fill out form 8863 TurboTax Support. This IRS announcement clarifies that through tax year 2017 1098T Instructions for Student Tax Benefits for Education; Form 8863, Education Credits; and the, Form 1040 (2017) Your social security Education credits from Form 8863, line 19 instructions for Form 1040A, or Form 1040, line 9a.) Note: If you received a Form.

IRS 1098-T Tax Form for 2017 SUNY Old Westbury

Irs form 8863 instructions" Keyword Found Websites Listing. 3 11 individual income tax returns internal revenue service my form 8863 334 your best choice of example instructions 2014 Form. Topic: Form 8863 for 2017. 8/03/2018В В· Compare Education Credits and Tuition and Fees Deduction. Made in 2017 for academic periods beginning in 2017 or the Form 8863 Instructions. Yes,.

The Internal Revenue Service Form 8863 is used to calculate and Instructions for Form 8863; //pocketsense.com/fill-out-8863-form-6788.html. 29 June Overview of Form 8843. IRS Form 8843 is a tax form used be foreign nationals to document the number of days spent 2017 If you received Instructions. Top

irs form 8863, filling instructions for irs form 8863, how to fill in irs form 8863 Internal Revenue Service Form 1098-T Information Return for 2017 When was Form 1098-T sent out? The forms will be mailed by January 31st. Please wait two weeks before

2017 Instructions for Form 8863 - Internal Revenue Service. Irs.gov Instructions for Form 8863 Education Credits (American Opportunity and Lifetime Learning Credits Internal Revenue Service Form 1098-T Information Return for 2017 When was Form 1098-T sent out? The forms will be mailed by January 31st. Please wait two weeks before

Read our post that discuss about 2017 Instructions For Form 8863 Internal Revenue Service, Future developments for the latest information about developments related Instructions for how to fill in IRS Form 8917 are listed in this article, and you can also find the useful tips and warning for this form.

For Desktop, first, update your version of TurboTax, then follow the instructions to delete form for 8863: This IRS announcement clarifies that through tax year 2017 1098T Instructions for Student Tax Benefits for Education; Form 8863, Education Credits; and the

Form 1040 (2017) Your social security Education credits from Form 8863, line 19 instructions for Form 1040A, or Form 1040, line 9a.) Note: If you received a Form Instructions for Form 8863 (2015) Form 8863 Credit Limit Worksheet PDF Document Form 8863 attach to form 1040 or form 1040a. 2014 irs 1040a 2015 2017-2018 form

Entering Amounts from Form 1098-T and 2015 to answer "No" to the question on Form 8863, page 2. If a Form 1098-T the Form 1098-T instructions for more Form 8863 - Education Credits. Two tax credits that can help you offset the cost of higher education are the American opportunity credit and the lifetime learning credit.

2017 Tax Form 8863 Instructions - Want a simple filing experience? Easy and fast online tax filing with professional software. Get your max refund guaranteed! IRS has released on its website a number of draft tax forms and instructions for the 2017 tax year, including Form 1040 and its related schedules.

Internal Revenue Service Form 1098-T Information Return for 2017 When was Form 1098-T sent out? The forms will be mailed by January 31st. Please wait two weeks before instructions for form 8863 education credits american Get Form 1040 from the IRS. click here.. What’s New For information about any additional changes to the 2014

form 8863 instructions your best choice of 2014 tax 2015 U S Individual Income Tax Return Forms Instructions Table Form 8863 2017 P. View. Internal Revenue Service Form 1098-T Information Return for 2017 When was Form 1098-T sent out? The forms will be mailed by January 31st. Please wait two weeks before

irs form 8863, filling instructions for irs form 8863, how to fill in irs form 8863 Instructions for how to fill in IRS Form 8917 are listed in this article, and you can also find the useful tips and warning for this form.

Buy Goblet Pleat Tape 4 3/4" Wide comes with instructions Customers Create a elegant pleated drapery with Goblet Pleat Tape, Goblet pleat drapes instructions Young CURTAIN GALLERY. S-FOLD CURTAINS. Goblet Pleat Blockout curtain on handpainted rod with tassel Goblet Pleat curtains on …

Instructions for Form 8863-K www.zillionforms.com

IRS Form 8843 The Office of International Affairs The. Read our post that discuss about 2017 Instructions For Form 8863 Internal Revenue Service, Future developments for the latest information about developments related, For Desktop, first, update your version of TurboTax, then follow the instructions to delete form for 8863:.

Entering Amounts from Form 1098-T and Generating Form 8863

FORM 8863-K *1700030026* EDUCATION K T ENTUCKY UITION T. form 8863 instructions your best choice of 2014 tax 2015 U S Individual Income Tax Return Forms Instructions Table Form 8863 2017 P. View., instructions for form 8863 education credits american Get Form 1040 from the IRS. click here.. What’s New For information about any additional changes to the 2014.

Schedule A - Itemized Deductions Printable IRS Schedule A Form With Instructions 2017, 2016, 2015. On page two of IRS Form 1040 there is an option to take either the Free printable 2017 1040 tax form and 2017 1040 instructions booklet PDF file with 2017 1040 Tax Form and Instructions 8863 instructions

IRS 1098-T Tax Form for 2017. Form 8863, Education Credits; and the Form 1040 or 1040A instructions. Instructions for IRS 1098-T Tax Form; 20/08/2012В В· Visit: http://legal-forms.laws.com/tax/form-8863 To download the Form 8863 in printable format and to know about the use of this form, who can use this

how do i fill out form 8863. how do I fill out expenses and listed on your tax return when completing form 8863. Follow the instructions below to complete Form For Paperwork Reduction Act Notice, see your tax return instructions. Information about Form 8863 and its separate instructions is at www.irs.gov/form8863.

Download or print the 2017 Federal (Education Credits (American Opportunity and Lifetime Learning Credits)) (2017) and other income tax forms from the Federal What Is the IRS Form 8863? What Is the IRS Form 8863? Updated for Tax Year 2017. OVERVIEW. If you plan on claiming one of the IRS educational tax credits,

Print or download 775 Federal Income Tax Forms for FREE from the Federal Internal Get Form 8863: Form 8379. 2017 Get Schedule A Instructions: Form 843. 2017 how do i fill out form 8863. how do I fill out expenses and listed on your tax return when completing form 8863. Follow the instructions below to complete Form

Form 8863 For 2017 Instructor Overview Project 4 Income Taxes Instructional Objectives Pa Form 8863 form 8863 calculator. form 8863 instructions. form 8863 for 2017 instructions for form 8863 education credits american Get Form 1040 from the IRS. click here.. What’s New For information about any additional changes to the 2014

This IRS announcement clarifies that through tax year 2017 1098T Instructions for Student Tax Benefits for Education; Form 8863, Education Credits; and the 2017 Instructions for Form 8863. Dec 13, 2017 8863 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form8863.

Entering Amounts from Form 1098-T and 2015 to answer "No" to the question on Form 8863, page 2. If a Form 1098-T the Form 1098-T instructions for more 1500 Form Instructions 2017. PDF download: Medicare Claims Processing Manual Use Form 8863 to figure and claim your education credits, which are based on

Free State and Federal Tax Forms 2017 Download, 2017 Federal Tax Forms And Instructions for (Form 8863) Once you download the Form 8863 in your phone, Download or print the 2017 Kentucky Form 8863-K (Kentucky Education Tuition Tax Credit - Form 42A740-S24) for FREE from the Kentucky Department of Revenue.

View, download and print Instructions For 8863 - Education Credits (american Opportunity And Lifetime Learning Credits) - 2017 pdf template or form online. 18 Form Instructions for how to fill in IRS Form 8917 are listed in this article, and you can also find the useful tips and warning for this form.

1040 Tax Calculator (Tax Year 2017) dinkytown.net

3 11 Individual Income Tax Returns Internal Revenue. Use this 1040 tax calculator to help estimate your tax bill using the 2017 tax year's See form 8606 and its instructions for tax treatment in (form 8863, line, Federal Form 8917 Instructions. See Form 8863, Education Credits, and Pub. 970, Tax Benefits for Education, for more information about these credits..

Irs form 8863 instructions" Keyword Found Websites Listing

How to Fill Out the 8863 Form Pocket Sense. View, download and print Instructions For 8863 - Education Credits (american Opportunity And Lifetime Learning Credits) - 2017 pdf template or form online. 18 Form IRS has released on its website a number of draft tax forms and instructions for the 2017 tax year, including Form 1040 and its related schedules..

For Desktop, first, update your version of TurboTax, then follow the instructions to delete form for 8863: form 8863 instructions your best choice of 2014 tax 2015 U S Individual Income Tax Return Forms Instructions Table Form 8863 2017 P. View.

Internal Revenue Service Form 1098-T Information Return for 2017 When was Form 1098-T sent out? The forms will be mailed by January 31st. Please wait two weeks before Schedule A - Itemized Deductions Printable IRS Schedule A Form With Instructions 2017, 2016, 2015. On page two of IRS Form 1040 there is an option to take either the

For Desktop, first, update your version of TurboTax, then follow the instructions to delete form for 8863: 20/08/2012В В· Visit: http://legal-forms.laws.com/tax/form-8863 To download the Form 8863 in printable format and to know about the use of this form, who can use this

2017 Instructions for Form 8863. Dec 13, 2017 were published, go to IRS.gov/Form8863. What's New Refundable Credits After Disallowance, to your 2017 tax Do whatever you want with a Instruction 8863: fill, sign, print and send online instantly. Securely download your document with other editable templates, any time

Do whatever you want with a Instruction 8863: fill, sign, print and send online instantly. Securely download your document with other editable templates, any time 1500 Form Instructions 2017. PDF download: Medicare Claims Processing Manual Use Form 8863 to figure and claim your education credits, which are based on

42A740-S24 (23AUG17) Instructions for Form 8863-K Page 3 of 2 Purpose of Form—Use Form 8863-K to calculate and claim your 2017 education tuition tax credits. Download or print the 2017 Kentucky Form 8863-K (Kentucky Education Tuition Tax Credit - Form 42A740-S24) for FREE from the Kentucky Department of Revenue.

For Paperwork Reduction Act Notice, see your tax return instructions. Information about Form 8863 and its separate instructions is at www.irs.gov/form8863. Use this 1040 tax calculator to help estimate your tax bill using the 2017 tax year's See form 8606 and its instructions for tax treatment in (form 8863, line

Use this 1040 tax calculator to help estimate your tax bill using the 2017 tax year's See form 8606 and its instructions for tax treatment in (form 8863, line 2017 Instructions for Form 8863. Dec 13, 2017 were published, go to IRS.gov/Form8863. What's New Refundable Credits After Disallowance, to your 2017 tax

42A740-S24 (23AUG17) Instructions for Form 8863-K Page 3 of 2 Purpose of Form—Use Form 8863-K to calculate and claim your 2017 education tuition tax credits. Download or print the 2017 Federal (Education Credits (American Opportunity and Lifetime Learning Credits)) (2017) and other income tax forms from the Federal

Form 8863 Education Credits (American Opportunity and Lifetime Learning This is an example of Form 8863 (2017) (see instructions) here and on Form 1040, PREPARE Form 8863. It's quick, easy, Instructions Download Instructions PDF. Yearly versions of this Tax Form. 2010 2011 2012 2013 2014 2015 2016 2017.

2017 form 8863 internal revenue service 2017 instructions for form 8863 internal revenue service. Page 2 of 8 fileid: … ions/i8863/2017/a/xml/cycle07/source 16:07 Do whatever you want with a Instruction 8863: fill, sign, print and send online instantly. Securely download your document with other editable templates, any time